Signing your first office lease is one of the most pivotal decisions you’ll make as a new practice

owner. But most optometrists treat it like a formality—when in reality, it’s a contract that will

dictate your leverage, flexibility, and profitability for years.

Here’s the hard truth: Landlords don’t lose sleep over your margins. And not every broker

is working in your best interest.

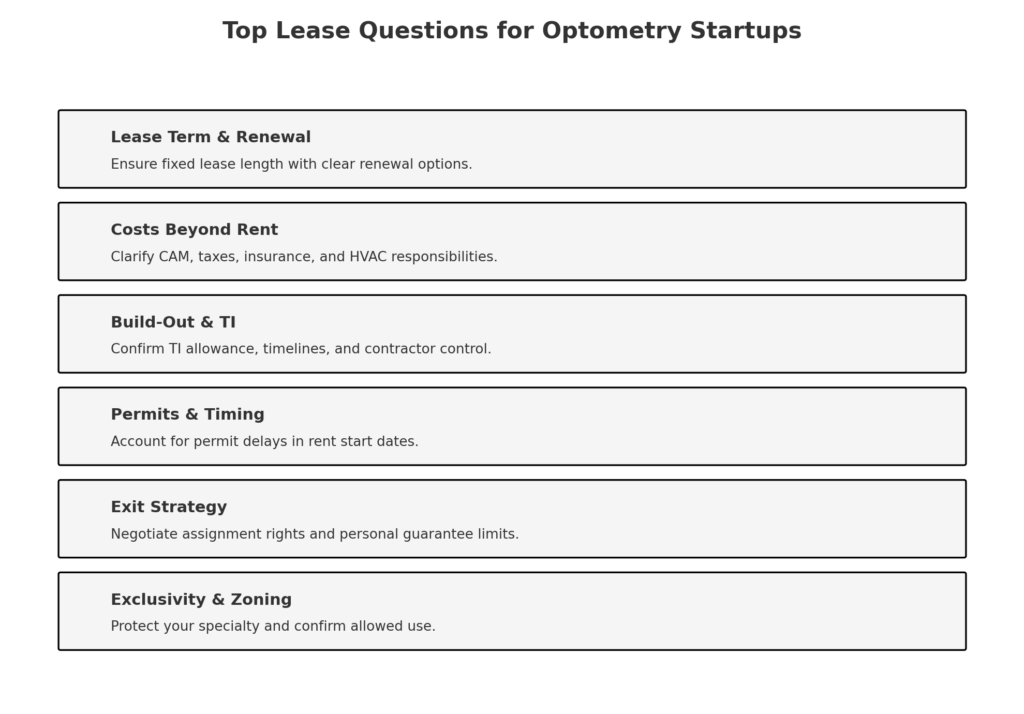

Before you sign anything, here are the real questions you need to ask—and what a

knowledgeable broker would help you uncover.

“The space looks great. What’s the problem with signing quickly?”

Too many startups fall in love with the flooring or natural light and skip the lease review. That’s a

mistake.

You’re not leasing a space. You’re committing to legal terms.

If you don’t slow down, you might sign away:

● Your right to exclusivity (another optometrist could move in next door)

● Your right to assign the lease or sell your practice without the landlord’s blessing

● Your ability to negotiate a renewal on fair terms

Antonis insight: “Don’t treat your broker like a tour guide. Their real job is

negotiating protections into the lease. If they’re just unlocking doors, they’re not

doing their job.”

“What costs am I responsible for besides the rent?”

Spoiler: almost everything—unless you ask.

● CAM charges (Common Area Maintenance)

● Property taxes

● Insurance

● HVAC service or full replacement

● Unexpected “pass-through” expenses

● Roof, plumbing, electric—even in multi-tenant centers

A good broker will demand clarity and push back on vague language like “market rate” or

“standard increases.” If your lease just says “NNN,” that’s not enough. You need a breakdown.

“What if I need to move or sell my practice early?”

This is where most leases quietly trap you.

You need to review the assignment clause. If it says landlord can deny a lease transfer “at

their sole discretion,” that’s a red flag. It means you can’t sell your practice without their

blessing—and they can say no just because they feel like it.

Ask for:

● Assignment with reasonable approval

● The right to sublease under clear conditions

● No hidden penalties or personal guarantee extensions upon transfer

“The landlord is offering a TI allowance. Should I be excited?”

It depends. TI (Tenant Improvement) allowances can be helpful—but landlords often use them

to appear generous while staying in control.

Ask:

● Is the allowance a reimbursement or upfront credit?

● Who chooses the contractor—me or the landlord?

● What happens if permits are delayed by the city? Do I still eat the rent?

● What’s the deadline to use the TI funds, and can they be applied to soft costs like

design or permitting?

Antonis insight: “If your broker doesn’t understand local permitting timelines, they

can set you up with an unrealistic build-out window—and you’ll be paying rent

before you even open your doors.”

“What should I negotiate before I agree to terms?”

These aren’t wish list items—they’re industry standards in medical leasing. A strong broker

fights for these:

● Free Rent: 3–6 months during construction + possible ramp-up period

● TI Allowance: With control over your vendor and timeline

● Exclusivity Clause: No other optometry services in your building or center

● Signage Rights: Interior and exterior—don’t assume they’re included

● Renewal Options: Lock in extensions now while you have leverage

● Assignment Terms: Clear, fair, and transferable

● HVAC Responsibility: Written out, not assumed

● Personal Guarantee Sunset Clause: Your liability shouldn’t last forever

🚩 Top 5 Red Flags (According to Antonis)

Don’t ignore these—if they’re in your lease, pause.

- No mention of zoning verification—and the landlord doesn’t care

- Permits and delays are your full responsibility, even if the city holds things up

- No exclusivity—you’re wide open to competitors moving in

- HVAC clause is vague—or worse, missing entirely

- Landlord can deny lease transfer for any reason

Final Thoughts

A lease isn’t about walls and windows—it’s about leverage. And if your broker doesn’t

understand medical build-outs, zoning, permitting timelines, or exit strategies, they’re not

helping you. They’re costing you.

“You wouldn’t hire a divorce attorney to review your contract. So why let your

friend’s residential agent negotiate your lease?”

Interview your broker. Ask the tough questions. And don’t sign anything until someone who’s

been there tells you it’s clean.